Invertir en el ladrillo es una inversión segura. O por lo menos así lo vemos cientos de inversores inmobiliarios. Además, gracias a los diferentes tipos de inversión , riesgo y metodología podremos elegir el tipo de inversión que más encaja con nuestro presupuesto y con nuestro perfil.

Si estás pensando en hacer inversiones a medio y largo plazo teniendo un control sobre las mismas y apostando por un sector estable y creciente a lago plazo, entonces los bienes raíces o bienes inmobiliarios son para ti.

Éstos nos ofrecerán una inversión refugio dado que, aunque también están ligados a los vaivenes de la economía, siempre a largo plazo tenderán a valer más que lo que nos costó.

¿Por qué invertir en inmuebles?

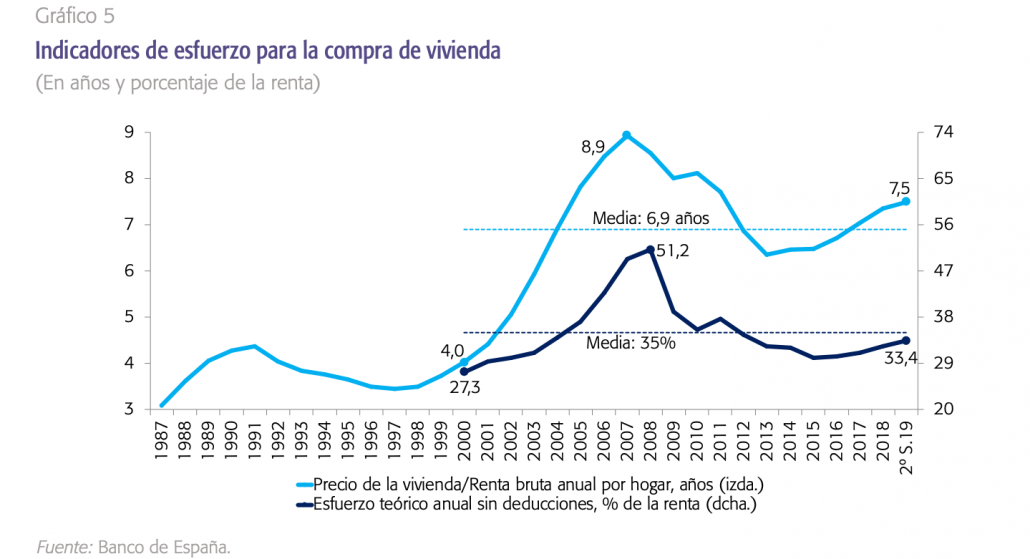

Si pensamos en un inmueble que comprásemos en plena época del «boom» inmobiliario del 2007, una vez entró la crisis tuvo una bajada la cual duró varios años, sin embargo como vemos una vez superamos la crisis vuelve a recuperar dado que el sector inmobiliario siempre está muy ligado a los aspectos macro.

Fijaros que el ciclo se repite cada 5 – 10 años según las crisis económicas, mirad la subida hasta 1991, la posterior bajada con la subida que culminó a finales de 2007.

Actualmente estamos en otro proceso de crecimiento que, a pesar de la crisis sanitaria covid-19, en mi opinión tenderá a seguir creciendo dado que ahora la gente invierte más en su hogar por la experiencia vivienda en la pandemia.

Cómo funciona la inversión inmobiliaria

Cuando invertimos en inmuebles, y en este artículo me centraré en comprar para rentar, obtendremos una ingresos mensuales vía alquiler.

El importe de ese alquiler cada año se actualiza según el índice IPC, el cual se ajusta según la variación del coste de vida. Este aspecto es muy positivo que otros tipos de inversiones, como por ejemplo las inversiones en activos financieros, no contemplan.

¿Pero por dónde empezar a invertir?

Seguramente lo primero que te venga a la cabeza sea comprar un piso. Sin embargo existen más tipos de inversiones inmobiliarias que podemos considerar como verás en este articulo.

Hoy vengo a hablarte de los diferentes productos de inversión en inmuebles que podemos encontrar en el mercado, sus principales ventajas e inconvenientes y cuál puede ser el más interesante acorde a tu perfil inversor.

Invertir en vivienda para alquilar

Es el más común y el más frecuente y también en donde encontramos mayor oferta en el mercado. Tiene varias ventajas frente al resto de inmuebles que lo convierten en un interesante activo a tener en cuenta y de hecho, la gran mayoría de inversores comienzan con este tipo de inversión.

Ventajas

- Mayor facilidad de alquiler: existe un mercado creciente de vivir de alquiler. Esto se agudiza con las nuevas generaciones, personas que asumen que pueden cambiar de residencia varias veces en su vida y además no quieren ataduras de hipotecas.

- Posibilidad de uso propio: al disponer de una vivienda puede darse el caso de que en alguna situación puedas disponer de ella para uso propio. Por ejemplo, una compra de vivienda que mientras no estamos residiendo en ella está alquilada y pasados unos años, podemos utilizarla como residencia.

- Mayor facilidad de compra: para adquirir una vivienda el banco da más facilidades frente a la compra de otro tipo de bienes inmuebles no residenciales. Esto es debido a que el banco lo considera un bien más seguro y estable. Y en caso de impagos, donde la vivienda pasaría a manos del banco, saben que por la tasación que hicieron podrán darle salida sin perder dinero.

Inconvenientes

- Menor rentabilidad: El porcentaje de rentabilidad de estos activos suele ser menor frente a otras opciones. Esto lo convierte en un activo para un perfil de inversor más conservador que prefiera más continuidad y estabilidad en el tiempo por parte del inquilino y una probabilidad mayor de tener más valor a largo plazo. 👉 Te recomiendo ver en artículo que preparé sobre rentabilidad del alquiler.

- Mayor dedicación: normalmente la inversión en vivienda conlleva un mayor tiempo de gestión que otro tipo de inversiones. Esto se debe a que, salvo si se pacta algo diferente por contrato, el propietario deberá dar asistencia al inquilino para tareas de mantenimiento y reparación. Las viviendas con el uso se van deteriorando, los electrodomésticos, etc. Esto ocasiona que tengamos que gestionar dichas tareas por nosotros mismos o bien a través de un agente externo el cual cobrará por dicho servicio y por tanto hará que nuestra rentabilidad merme. 👉Tip: siempre puedes contratar una empresa de gestión de alquileres como hice yo.

- Impagos y desahucios: un gran riesgo de las inversiones en vivienda es alquilarlo y que el inquilino no cumpla con los pagos de alquiler. Esto, a diferencia de otros activos, se complica mucho dado que la ley para los desahucios en caso de viviendas protege mucho al inquilino. Todos tenemos derecho a una vivienda digna por lo que si nos encontramos con un inquilino que no pague pueden pasar años hasta que sea desahuciado. Esto conlleva que durante el periodo que no pague el inquilino el propietario será el responsable de todos los gastos que conlleva la vivienda: cuotas de amortización de deuda hipotecaria (si las hay), gastos de comunidad y recibos de IBI. Es por ello que es muy importante hacer una buena selección del inquilino antes de ceder la vivienda.

Inversión en locales comerciales

Los locales o bajos comerciales son una inversión inmobiliaria que están muy vinculados al estado de la economía. Cuando estamos en una época de crisis, veremos muchos locales en alquiler, y en épocas de crecimiento, habrá escasez o pocos disponibles.

Aquí nuestro inquilino será un autónomo o una empresa y por tanto tendremos una serie de pasos diferentes a la inversión en residencial.

Ventajas

- Mayor rentabilidad: la rentabilidad de los locales comerciales vía alquiler es de las mayores de todos los bienes inmuebles. Dependerá del tipo de local comercial, la ciudad, la zona, el tipo de negocio que nos lo vaya a alquilar, pero en cualquiera de los casos la rentabilidad media es muy probable que supere a la inversión residencial.

- Menor dedicación: los locales comerciales no tienen un mantenimiento como las viviendas. Esto se debe a que el inquilino que alquila el inmueble lo pondrá acorde al negocio que quiera montar por tanto todo el mantenimiento de lo instalado será de su cuenta. En el caso además de averías en suministros: luz, agua, teléfono… el propietario no tiene que hacerse cargo de los mismos quedando como tareas propias del inquilino.

- Revalorización: al igual que la vivienda los locales comerciales tienen la ventaja de asimilar la inflación con el paso de los años y tener una valoración a largo plazo. Como ejemplos siempre pongo los locales que adquiere Amancio Ortega: muy altos de precio pero siempre en primera línea con lo que las valoraciones pasados muchos años serán multimillonarias.

- Facilidad en desahucio: si un inquilino entra en impago el desahucio en locales comerciales es mucho más ágil que en vivienda teniendo unos tiempos mucho más cortos para recuperar el inmueble.

Inconvenientes

- Menor demanda: normalmente es mucho más complicado alquilar un local comercial que una vivienda. Esto se debe a que para los locales comerciales es necesario encontrar a un inquilino que haga una inversión para arrancar su negocio, un análisis detallado del mismo, reformas, permisos etc. Esto ocasiona que la demanda de inquilinos sea menor y posiblemente necesitemos varios meses desde que compremos el local hasta que finalmente esté alquilado.

- Menor oferta: invertir en vivienda es más sencillo al existir más oferta en el mercado. En el caso de los bajos comerciales la cantidad es menor (en un edificio hay muchas plantas con viviendas, los locales sólo están en la planta de calle). Esto hace que necesitemos buscar mucho y muy bien hasta que encontremos un local interesante para invertir.

- Dificultad de financiación: pedir un préstamo para invertir en locales no es tan accesible al conllevar más riesgo de impago. Los bancos exigirán un pago inicial o entrada mayor frente a la vivienda.

- Riesgo de pérdida comercial: con esto quiero decir que podemos tener un local muy bueno y por algún tipo de circunstancia externa sufre un cambio en lo comercial que pueda ser. Supongamos que el Ayuntamiento hace obras en la zona, cambios en el tráfico de la gente, etc. Son aspectos que pueden afectar para bien o para mal en lo comercial que pueda ser un local y por tanto en la rentabilidad y en su valor.

Inversión en oficinas

Al igual que los locales comerciales las oficinas están muy vinculadas al estado económico de un país. Hablamos o de primeras plantas de edificios residenciales o bloques completos destinados a oficina. No cuentan con cédula de habilatibilidad y por tanto, tienen estrictamente uso comercial.

Ventajas

- Buena rentabilidad: normalmente mejor que los pisos pero peor que los locales comerciales. No existe una relación directa de la rentabilidad con la ubicación puesto que las oficinas normalmente no precisan de zona muy comercial para poder alquilarse bien. Hablamos en términos generales ya que sí que puede haber casos donde la ubicación de la oficina para determinados negocios sea importante: por ejemplo una inmobiliaria.

- Desahucio: En caso de impagos podremos echar a nuestro inquilino en menor tiempo como ocurre en los locales comerciales.

- Oferta: la cantidad de oficinas disponibles para invertir es también menor que la de viviendas pero muy superior a los locales comerciales. Es muy probable que ofrezcan ofertas en “lotes” por lo que pueden adquirirse al mismo tiempo varias oficinas y por tanto conseguir un mejor precio y posibilidad de diversificar.

Inconvenientes

- Cantidad de posibles inquilinos: está muy vinculado como hemos mencionado a cómo vaya la economía y por tanto habrá grandes variaciones en su demanda. De hecho al llegar una crisis son los primeros inmuebles en quedarse vacíos.

- Mantenimiento: es posible que, dependiendo del tipo de oficina y de las características de la misma, tengamos que realizar algún tipo de mantenimiento al igual que ocurre con las viviendas. En este caso podría tratarse de electrodomésticos u otros elementos mobiliarios con los que se haya alquilado.

Invertir en plazas de garaje

La inversión en plazas de parking son muy frecuentes en grandes ciudades. Aquí os menciono el alquiler para particulares individuales, no en la inversión en grandes parkings.

Existen muchos inversores inmobiliarios que están especializados en este tipo de inmuebles y consiguen crear patrimonio y muchas rentas con ellos.

Ventajas

- Escasez: las plazas de aparcamiento disponibles van disminuyendo con el paso del tiempo, o mejor dicho, es algo que no tiene normalmente capacidad de ampliación. Dependerá de la ubicación y la facilidad de aparcamiento para que esta inversión sea rentable. Si ponemos las zonas céntricas de capitales de provincia o ciudades como Barcelona o Madrid, el tener una inversión en una plaza de parking supone casi seguro tener una rentabilidad desde el primer día ya que la demanda supera con creces la oferta.

- Buena rentabilidad: las plazas de aparcamiento han incrementado su rentabilidad con el paso del tiempo debido al punto que os menciono, se convierten en bienes escasos. Y a mayor demanda y menos oferta más rentabilidad obtendremos al poder incrementar el precio de alquiler.

- Bajo mantenimiento: es escaso o casi nulo. Aquí como propietarios tendremos que hacer frente a el impuesto del IBI y a los gastos de la comunidad, los cuales debido al bien, suelen ser de poco importe.

- Importe de inversión: este tipo de inversión no supone grandes importes de compra. Dependerá mucho de la ciudad y su ubicación pero siempre será la opción más económica dentro de los diferentes tipos de inversiones inmobiliarias.

Inconvenientes

Este tipo de inversores busca hacer crecer su patrimonio poco a poco y sobre todo analizando bien las ubicaciones para asegurarse no sólo rentabilidad si no revalorización asegurada. Como principales desventajas destacaría:

- Tiempo de gestión: si bien es cierto que el mantenimiento es muy escaso, la gestión de las mismas sí que requiere de mayor tiempo. Posiblemente con unas pocas plazas de parking no será necesario mucha dedicación pero si hablamos de gestionar 15, 30 o más plazas de aparcamiento sí que tendremos que dedicarle tiempo salvo si lo tenemos todo muy automatizado (cobro por recibo bancario, contratos a larga duración etc).

- Escasez: es difícil encontrar plazas de parking en precios económicos en buenas ubicaciones. Comprar una plaza de aparcamiento en zona céntrica de una capital es apuesta segura sin embargo es complicado de encontrar y sobre todo a un precio asequible.

- Mayor estabilidad económica: debido a estar dirigido a particulares no están tan ligadas a los ciclos económicos como ocurre con los locales y oficinas.

- Potencial limitación de uso: encuentro una posible amenaza con el paso del tiempo. Esto se debe a que las plazas de parking no amplían su tamaño y los vehículos cada vez los hacen de mayor tamaño. Además, el uso de coches eléctricos es cada vez mayor, y si nuestra plaza de parking no dispone de enchufe es algo muy limitante. Esto puede llevar a que dentro de unos años lo que consideramos hoy una buena plaza de garaje dentro de unos años ya no lo sea.

Invertir en terrenos

En la época de crecimiento económico pudimos comprobar cómo propietarios de terrenos hicieron grandes fortunas con la venta de los mismos a promotoras para la construcción de viviendas. Sin embargo es un tipo de inversión de mayor riesgo, y no apto para principiantes.

Ventajas

- Precio: normalmente los terrenos sin nada construido tienen un precio menor y su valor estará más en el potencial del proyecto que pueda llevarse a cabo en él. Esto cambia dependiendo de si es terreno urbanizable o no pero en ambos casos al no haber nada construido podremos comprar grandes extensiones por menos importe que otros activos.

- Diversificar: una característica de estos activos es que permiten diversificarlo en varias funciones. Puede comprarse para explotar como un terreno cultivable, destinar como zona de aparcamientos etc.

Inconvenientes

- Rentabilidad baja o nula: disponer de un terreno no nos proporciona ninguna rentabilidad dado que no es posible en principio recibir un alquiler por el mismo. Tendremos que valorar el cederlo a un tercero y que éste lo explote existiendo en este posible caso pero las limitaciones del mismo lo sitúan como el activo menos demandado. En ocasiones alquilan espacios para poner carteles publicitarios etc

- Dudosa especulación: es posible una posible recalificación de nuestro terreno o que en un futuro haya un desarrollo en la zona y multiplique su valor. Sin embargo es posible que no pase nada y tengamos un bien que no sólo no nos proporciona rentabilidad si no que tampoco nos aseguramos que con el paso del tiempo aumente su valor.

- Ubicación: el precio del terreno está muy condicionado por la ubicación del mismo encontrando terrenos muy caros en ubicaciones más céntricas y prácticamente sin valor en sitios más alejados. Aquí la variación es mayor al del resto de activos y por tanto es más difícil de hacer un seguimiento y una valoración más precisa.

Conclusiones

- Como hemos podido ver en todos los casos existen ventajas e inconvenientes que hace que todos los inmuebles bien gestionados sean buenos para invertir.

- Dependerá de factores personales, financieros y disponibilidad para definir nuestra estrategia de inversión.

- Recomiendo invertir en bienes inmuebles para crear patrimonio en el largo plazo y conseguir la libertad financiera a base de rentas.